This AI Stock Just Snagged an NFL Deal. Should You Buy Shares Here?

/AI%20(artificial%20intelligence)/AI%20engineer%20working%20on%20laptop%20by%20ART%20STOCK%20CREATIVE%20via%20Shutterstock.jpg)

Artificial intelligence (AI) has been one of the market’s most exciting themes, minting winners like Nvidia (NVDA) and Palantir (PLTR) as well as fueling endless speculation about which company could be next. One name that has been quietly climbing the ranks is BigBear.ai (BBAI), a data analytics and defense-focused AI player whose stock has surged triple digits over the past year. Known for helping government and defense agencies make sense of complex data, the company is now stepping into a much bigger spotlight.

On Aug. 20, BigBear.ai announced a multi-year partnership with the Washington Commanders team, instantly grabbing the market’s attention. As part of the deal, the team’s training facility has been rebranded the BigBear.ai Performance Center, and the company’s logo will now be splashed across stadium suites, practice jerseys, and other high-visibility assets. For an AI company that has been operating largely behind the scenes, this NFL tie-up marks a bold play to boost its national profile.

CEO Kevin McAleenan called the deal a sign that BigBear.ai is “going on offense,” using the NFL stage to chase broader growth opportunities and even leverage its AI expertise to enhance the fan experience. So, with this new development in play, should investors buy BBAI stock now?

About BigBear.ai Stock

Virginia-based BigBear.ai focuses on AI solutions that serve the defense, national security, and critical infrastructure sectors. Its technology applies predictive analytics and data-driven insights to help organizations manage the demands of complex, distributed, and mission-critical environments. The company’s market capitalization currently stands at approximately $2 billion.

This AI stock has been on a tear, grabbing Wall Street’s attention with a jaw-dropping 240% surge over the past year, far outpacing the S&P 500 Index’s ($SPX) modest 16% gain. Even in 2025, despite cooling momentum, BBAI stock has climbed 24%, still well ahead of the broader index’s 10% rise.

Recently, though, sentiment has wavered as investors soured over its less-than-stellar latest earnings report earlier this month. Yet, on Aug. 20, the stock managed to score a 2% bump after announcing the high-profile NFL partnership, putting the spotlight back on its growth story.

A Look Inside BigBear.ai’s Q2 Performance

On Aug. 11, BigBear.ai dropped its fiscal 2025 second-quarter results, and investors clearly didn’t like what they saw. Shares tumbled more than 15% the next trading session as headline numbers missed expectations and revealed deeper challenges in the business. Revenue came in at $32.5 million, marking an 18% year-over-year (YOY) decline, largely due to disruptions in U.S. Army programs that weighed heavily on the top line. That figure also fell well short of Wall Street’s $40.9 million forecast, adding to investor disappointment.

Profitability also came under pressure. Gross margin narrowed to 25% compared with 27.8% a year ago, reflecting challenges in operating efficiency. At the same time, the company ramped up research and development spending to advance its core AI products, which pushed adjusted EBITDA losses deeper into the red. The company reported a loss of $8.5 million on this metric, more than double the $3.7 million loss posted in the same quarter last year.

On the bottom line, BigBear.ai’s losses widened significantly. Net loss ballooned to $228.6 million, dramatically higher from $14.4 million a year earlier. The steep decline was due in part to non-cash derivative remeasurement charges and a hefty $71 million goodwill impairment. Meanwhile, EPS came in at a loss of $0.71, far worse than both the prior-year loss of $0.06 and the $0.06 per-share loss anticipated by analysts.

It wasn’t all bad news, though. The company highlighted sequential improvements to its balance sheet, ending the quarter with a record $390.8 million in cash balance as of June 30, 2025, compared with just $50.1 million at the end of 2024. BigBear.ai also reported a healthy backlog of $380 million, offering some visibility into future demand.

Still, guidance cast a shadow over the outlook. Management slashed its full-year 2025 revenue forecast to between $125 million and $140 million, down sharply from the prior range of $160 million to $180 million. Additionally, due to uncertainty surrounding key Army programs and anticipated new growth investments in the second half, the company entirely withdrew its previously issued adjusted EBITDA guidance for the year.

What Do Analysts Think About BigBear.ai Stock?

Despite a lackluster Q2 showing, analysts aren't writing off BBAI stock just yet. On Aug. 12, Cantor Fitzgerald analyst Jonathan Ruykhaver bumped up his price target to $6 from $5 while reiterating an “Overweight” rating. While BigBear.ai continues to grapple with “near-term execution issues,” the maintained bullish stance highlights expectations around “secular tailwinds and improved financial flexibility.”

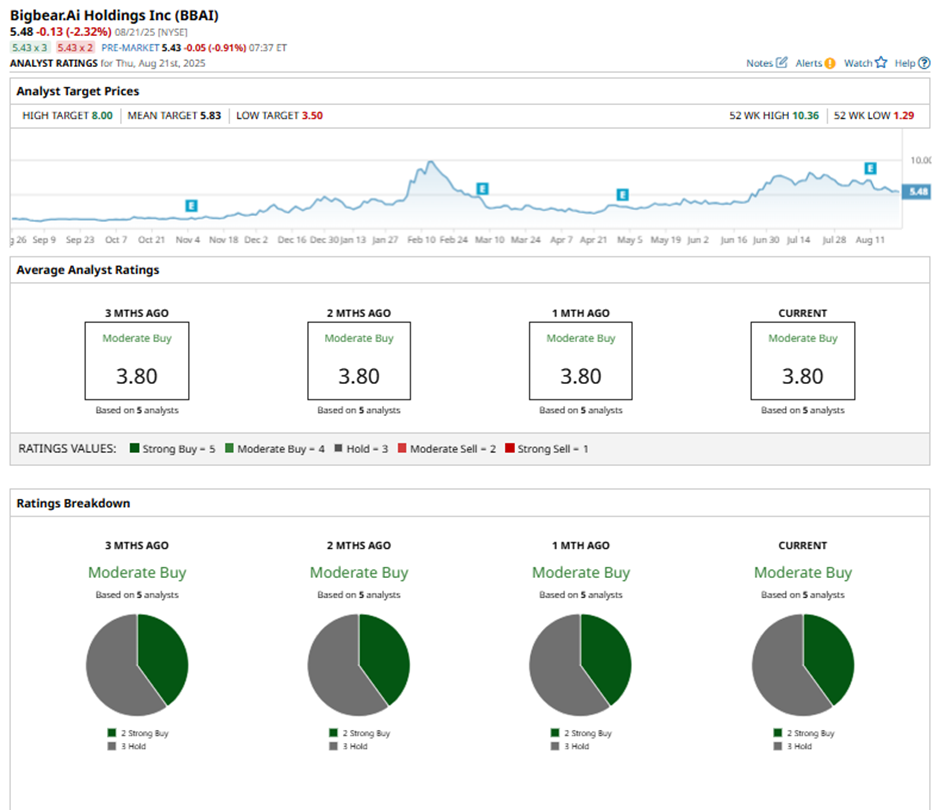

While the coverage is limited, Wall Street remains optimistic, with a consensus “Moderate Buy” rating overall. Of the five analysts offering recommendations, two advocate a “Strong Buy,” and the remaining three urge investors to “Hold.” The average analyst price target of $5.83 represents potential upside of 6% from current market prices. However, the Street-high target of $8 suggests an impressive 45% rally from current levels.

BigBear.ai’s latest quarter highlighted ongoing financial headwinds, sparking a sharp pullback in BBAI stock. Still, the company’s substantial cash reserves, sizable backlog, and recent NFL partnership offer potential catalysts ahead. That said, execution risks remain a sticking point, and the company must show it can turn these opportunities into sustainable growth before investor sentiment shifts back in its favor.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.