Are Wall Street Analysts Bullish on Hershey Stock?

With a market cap of around $38 billion, The Hershey Company (HSY) is a leading global manufacturer of chocolate, non-chocolate confectionery, pantry items, and snacks. Operating through its North America Confectionery, North America Salty Snacks, and International segments, the company markets iconic brands like Hershey’s, Reese’s, Kit Kat, and SkinnyPop in over 80 countries.

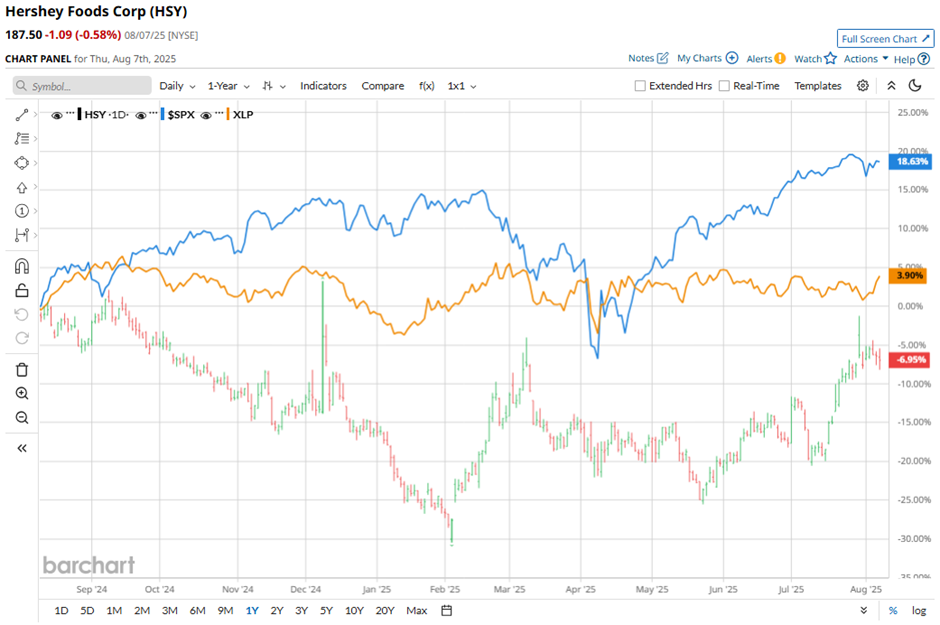

Shares of the Hershey, Pennsylvania-based company have underperformed the broader market over the past 52 weeks. HSY stock has dropped 6.2% over this time frame, while the broader S&P 500 Index ($SPX) has gained 21.9%. However, shares of Hershey are up 10.7% on a YTD basis, outpacing SPX’s 7.8% rise.

Narrowing the focus, shares of the chocolate bar and candy maker have lagged behind the Consumer Staples Select Sector SPDR Fund’s (XLP) over 5% return over the past 52 weeks.

Shares of Hershey rose 1.4% on Jul. 30 after the company beat Q2 2025 estimates with adjusted EPS of $1.21 and revenue of $2.6 billion, driven by strong Easter demand and a 21% sales volume increase from planned inventory and supply chain changes. The company also benefited from earlier Halloween shipments, a 5% price increase to offset soaring cocoa costs, and steady growth in its salty snacks segment, led by SkinnyPop and Dot’s.

For the fiscal year ending in December 2025, analysts expect HSY’s adjusted EPS to decline 36.8% year-over-year to $5.92. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

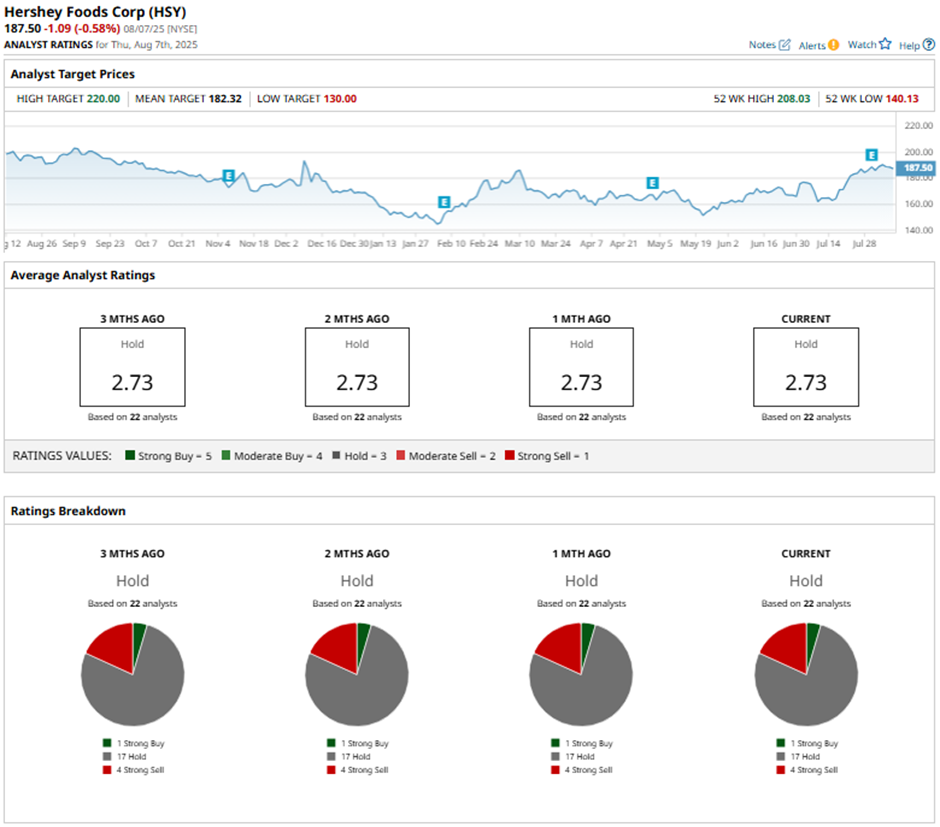

Among the 22 analysts covering the stock, the consensus rating is a “Hold.” That’s based on one “Strong Buy” rating, 17 “Holds,” and four “Strong Sells.”

On Jul. 31, TD Cowen’s Robert Moskow increased Hershey’s price target to $204 and maintained a “Hold” rating.

As of writing, the stock is trading above the mean price target of $182.32. The Street-high price target of $220 implies a potential upside of 17.3% from the current price.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.