Ross Stores Stock Outlook: Is Wall Street Bullish or Bearish?

/Ross%20Stores%2C%20Inc_%20logo%20by-%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

Dublin, California-based Ross Stores, Inc. (ROST) is a leading off-price apparel and home fashion retailer in the United States. With a market cap of $46.4 billion, it operates under the brands Ross Dress for Less and dd’s DISCOUNTS, offering brand-name clothing, footwear, accessories, and home goods at discounted prices.

The retail giant has underperformed the broader market over the past year. ROST stock has surged 7% over the past 52 weeks and dropped 3.1% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 21.1% gains over the past year and has returned 7.9% in 2025.

Narrowing the focus, Ross Stores has also lagged behind the industry-focused VanEck Retail ETF’s (RTH) 24.1% surge over the past year and 9.6% uptick on a YTD basis.

On May 22, ROST reported its Q1 results, and its shares dipped over 9% in the following trading session. Investor concerns drove the sharp decline after the company withdrew its full-year guidance, citing macroeconomic uncertainty and potential tariff impacts, especially since over half its merchandise is sourced from China. On the bright side, its EPS of $1.47 surpassed Wall Street expectations of $1.43. The company’s revenue was $4.98 billion, topping Wall Street forecasts of $4.97 billion.

For the current fiscal year, ending in January 2026, analysts expect ROST to deliver a 1.4% year-over-year decline in earnings to $6.23 per share. On a more positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

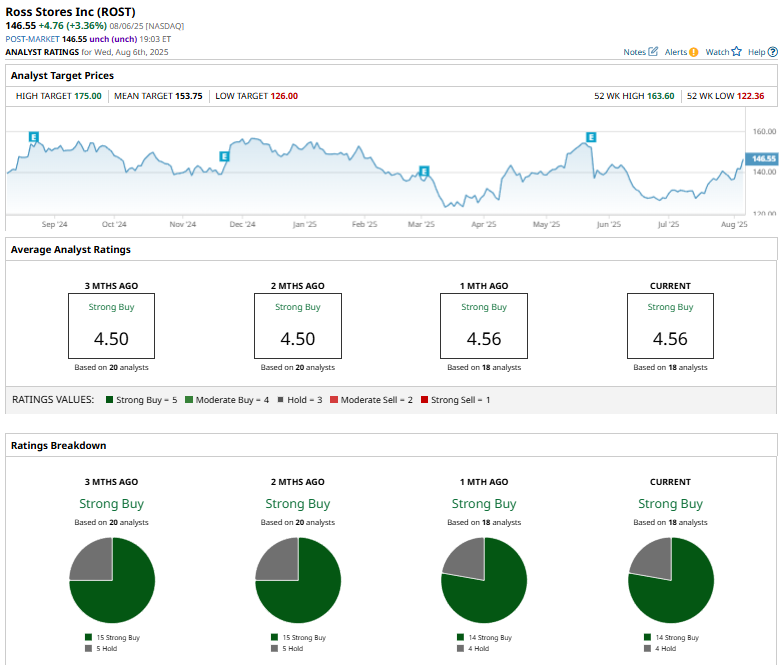

The stock holds a consensus “Strong Buy” rating overall. Of the 18 analysts covering the stock, opinions include 14 “Strong Buys” and four “Holds.”

This configuration is more bearish than two months ago, when 15 analysts gave “Strong Buy” recommendations.

On Jul. 2, Financial Group Inc. (JEF) upgraded ROST from a “Hold” to a “Buy” rating. The firm also raised its price target to $150, citing improved traffic trends, solid inventory management, and a favorable off-price retail environment as key catalysts for potential upside in the stock.

ROST’s mean price target of $153.75 represents a 4.9% premium to current price levels, while its Street-high target of $175 suggests a 19.4% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.