AMD Stock Slips After Q2 Earnings, But Here’s Why It’s a Buying Opportunity

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

Advanced Micro Devices’ (AMD) second-quarter results last night exceeded expectations. However, the market responded negatively, sending AMD shares down more than 5% in early trading today. The pullback was driven by lower data center artificial intelligence (AI) revenue. However, AMD’s long-term growth trajectory remains solid.

AMD’s Strong Q2 Results Overshadowed by AI Revenue Decline

The primary reason behind the pullback was a year-over-year decline in AMD’s data center artificial intelligence (AI) revenue, which spooked the market. A key contributor to this softness was the impact of U.S. export restrictions, which significantly reduced sales of AMD’s MI308 series accelerators to China. Additionally, the transition to AMD’s next-gen MI350 series also temporarily affected sales as customers awaited the new products.

Despite that, AMD delivered a strong quarter. Revenue for Q2 came in at $7.7 billion, marking a 32% increase from the same period last year. This was driven by record sales of Ryzen and EPYC processors and robust demand in the gaming segments. AMD saw strength across most of its business lines, which was enough to more than offset the short-term challenges in AI-related data center revenue.

The Data Center segment generated $3.2 billion in revenue, up 14% from last year, powered by increasing adoption of EPYC CPUs across both cloud and enterprise customers. Meanwhile, the Client and Gaming segments posted impressive numbers. Client revenue surged 67% year-over-year to a record $2.5 billion, propelled by booming sales of Ryzen desktop CPUs, and a favorable product mix.

Gaming revenue rose 73% to $1.1 billion, driven by strong demand for AMD’s newly launched gaming GPUs and higher semi-custom shipments as inventory levels returned to normal. With the holiday season approaching, gaming sales are likely to remain elevated.

AMD’s AI Business Poised for a Solid Rebound

While the data center AI business declined in Q2, it remains well-positioned to mark a significant reacceleration in growth. The company has laid out a roadmap that includes a significant ramp-up in its AI data center business. Management has confidence that this segment alone could grow to tens of billions in annual revenue over time. Momentum is already building. AMD advanced its MI300 and MI325 accelerator products during the quarter, securing new business from major cloud providers and Tier 1 customers. This sets the stage for a broader rollout of the MI350 series, which is designed to handle demanding AI workloads at lower cost and complexity.

Looking ahead, AMD expects its top line to mark sequential growth led by the ramp of its MI350 GPU line. In parallel, development of its next-generation MI400 series is progressing rapidly, and customer interest is already high. AMD is actively engaging with a growing number of enterprise and cloud partners to support large-scale AI deployments by 2026.

AMD has also been making strategic investments to solidify its AI ecosystem. It has expanded both hardware and software capabilities, both organically and through acquisitions. Recent additions include teams from Brium and Lamini, complementing earlier AI software acquisitions like Nod.ai, Mipsology, and Silo AI.

On the hardware front, AMD acquired ZT Systems’ data center design team, integrating their expertise to accelerate development of its Helios rack-scale solutions.

AMD’s growing influence in sovereign AI initiatives adds another exciting growth vector. Governments around the globe are increasingly choosing AMD to power secure national AI infrastructure. With over 40 active sovereign AI engagements worldwide, AMD is becoming a key player in global AI infrastructure buildouts.

Is AMD Stock a Buy Now?

While AMD’s Q2 earnings initially triggered a market pullback due to short-term softness in data center AI revenue, the broader picture tells a much more optimistic story. The company posted strong overall results, driven by surging demand across its client, gaming, and traditional data center businesses. More importantly, AMD’s long-term AI strategy is gaining traction, with a robust product roadmap, strategic acquisitions, and deepening partnerships laying the foundation for accelerated growth.

The upcoming ramp of the MI350 series, strong customer interest in the MI400 line, and AMD’s expanding role in sovereign AI projects will strengthen its position in the AI space.

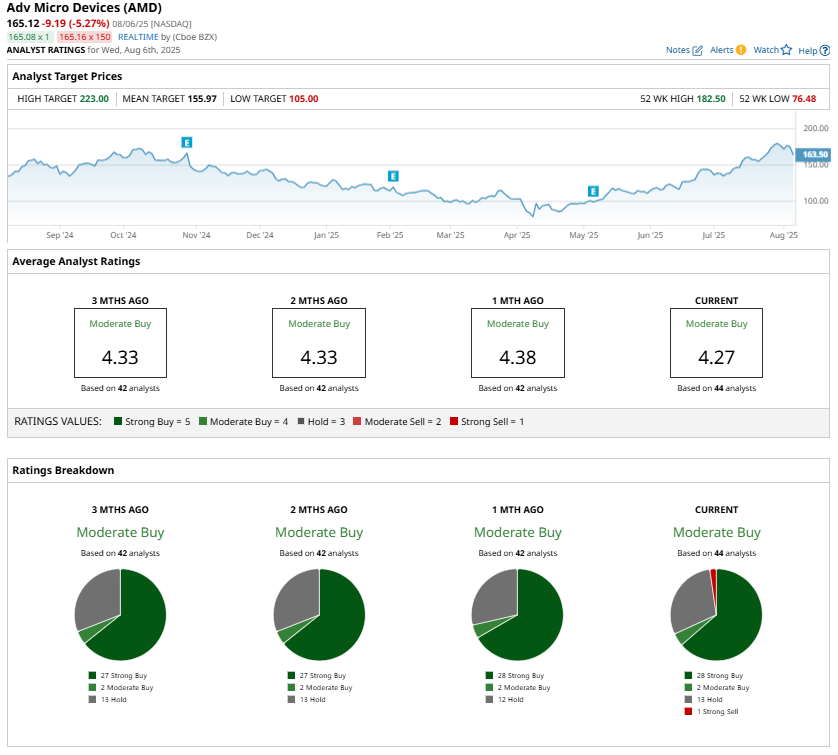

While Wall Street maintains a “Moderate Buy” consensus rating on AMD stock, for long-term investors, the current dip represents a compelling buying opportunity.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.