Are Wall Street Analysts Bullish on Oracle Stock?

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

With a market cap of $718.1 billion, Oracle Corporation (ORCL) is a global leader in enterprise-grade software, hardware, and cloud services. The company offers a comprehensive suite of solutions, including databases, middleware, applications, and engineered systems, tailored for businesses, governments, and institutions worldwide.

Shares of the Austin, Texas-based company have significantly outperformed the broader market over the past 52 weeks. ORCL stock has climbed nearly 100% over this time frame, while the broader S&P 500 Index ($SPX) has gained 21.5%. In addition, shares of Oracle have surged 53.4% on a YTD basis, compared to SPX's 7.1% rise.

Looking closer, the software maker stock has also outpaced the Technology Select Sector SPDR Fund's (XLK) 31.4% return over the past 52 weeks.

Shares of Oracle soared 13.3% following its Q4 2025 results on Jun. 11. The company reported adjusted EPS of $1.70 and revenue of $15.9 billion, topping forecasts. Oracle raised its fiscal 2026 revenue forecast to at least $67 billion, implying 16.7% growth, driven by accelerating demand for Oracle Cloud Infrastructure (OCI) and AI workloads. The management highlighted that total cloud growth is expected to rise over 40% in 2026.

For the fiscal year ending in May 2026, analysts expect ORCL's EPS to grow 20.7% year-over-year to $5.31. The company's earnings surprise history is mixed. It beat or met the consensus estimates in three of the last four quarters while missing on another occasion.

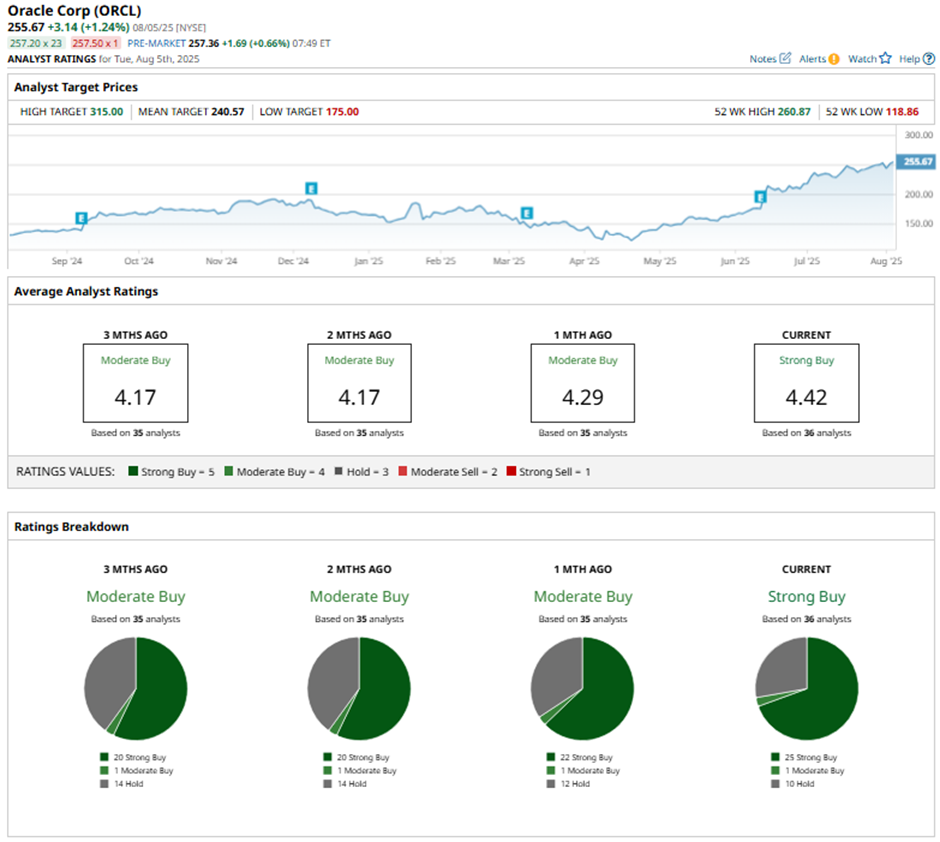

Among the 36 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 25 “Strong Buys,” one “Moderate Buy” rating, and 10 “Holds.”

This configuration is more bullish than three months ago, with 20 “Strong Buy” ratings on the stock.

On Aug. 5, BofA analyst Brad Sills raised Oracle's price target to $295 while maintaining a “Neutral" rating, citing strong capex guidance from Microsoft and Meta as positive signals for AI infrastructure demand, benefiting Oracle as a key player in the AI cycle.

As of writing, the stock is trading above the mean price target of $240.57. The Street-high price target of $315 implies a potential upside of 23.2% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.